On September 5, the Center for Exhibition Industry Research released the Q2 2023 edition of the CEIR Index, which measures the performance of the B2B exhibition market in North America.

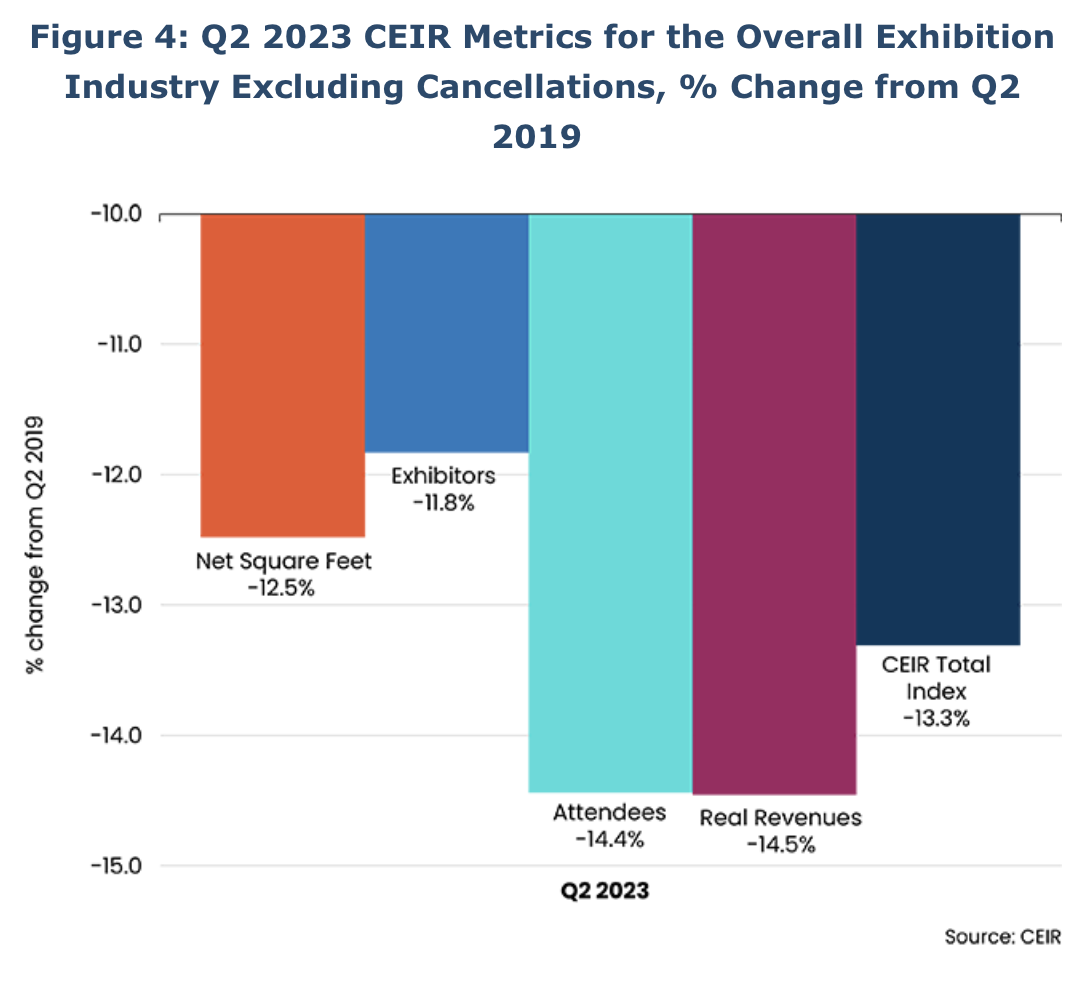

The verdict: The market’s Q2 2023 overall performance (excluding event cancellations) came in 13.3 percent below what it was in Q2 2019. While that figure is a huge improvement over market performance in Q2 2022, which was 25.7 percent below Q2 2019’s numbers, the exhibitions market in Q2 2023 fell back 1.6 percent from its Q1 2023 performance.

By comparison, inflation-adjusted gross domestic product in the U.S. grew by a total of 7.6 percent between Q2 2019 and Q2 2023. In Q2 2023, the annualized rate of growth was 2.1 percent.

The Nitty Gritty

The index measures four areas of exhibition performance:

• Total number of exhibitors in Q2 2023 was 11.8 percent lower than in Q2 2019.

• Total net square feet in Q2 2023 was 12.5 percent less than that of Q2 2019.

• Total number of attendees in Q2 2023 was 14.4 percent lower than in Q2 2019.

• Total revenue in Q2 2023 was 14.5 percent below that of Q2 2019.

Looking Ahead to Next Year

Among the 14 industry sectors that CEIR monitors, the report predicts that two—consumer goods/retail trade and education—will lag behind the overall exhibition industry over the next 12 months. From a wider perspective, “Q4 2023 through mid-2024 will be challenging for the exhibition industry as the economy slows down and businesses are more cautious. ... The impact of monetary tightening on the economy tends to have a long lag, and the strong inversion of interest rates, as seen since autumn 2022, often precedes recession,” notes the report’s authors.

With a 45 to 50 percent probability of a recession by mid-2024, according to the report, “businesses that anticipate recession are cutting back expenses and head counts. However, if there is recession, it likely will be short and shallow. ... There is pent-up consumer demand for services including travel and tourism, most large corporations still are flush with cash, and there is a race across most industries to adopt new technologies such as artificial intelligence and electric vehicles.”

In addition, Dr. Allen Shaw, chief economist for Global Economic Consulting Associates and a CEIR consultant, says that “greater numbers of foreign participants will support recovery of the volume of attendance and exhibitors. A full recovery for the industry is expected [by end of] 2024.”

For B2B Exhibitions, a Mixed Bag Going Forward

Overall, trade shows still lag compared to their 2019 editions and a coming recession is possible. But the return of international attendees could bring 2024’s events closer to their pre-Covid performance.

0 comments

Hide comments