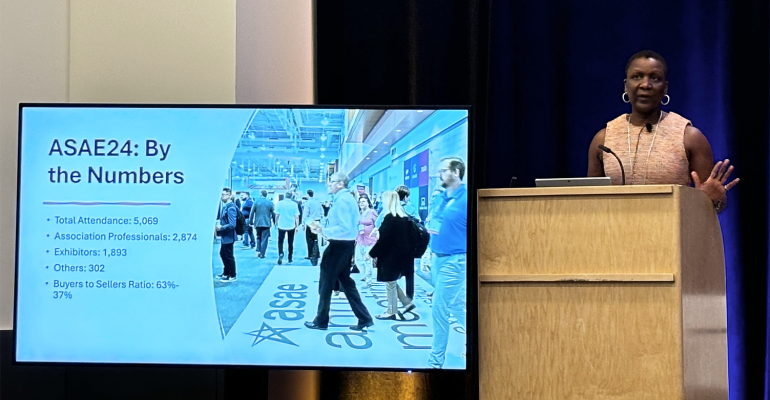

In an indication that business events have solid momentum right now, the American Society of Association Executives drew 5,070 participants—including 2,900 association executives and planners—to its 2024 annual meeting, held August 10 to 13 at the Huntington Convention Center in Cleveland. That figure is 2.4 percent higher than for the 2023 event at the Georgia World Congress Center in Atlanta.

On August 12, ASAE held a press conference for industry journalists and local reporters, touching on the $6-million economic benefit the meeting generated for Cleveland. That data served as a lead-in to announcing the results of a nationwide research initiative titled “The Power of Associations.”

“This new study quantifies the power of associations to boost America's economy and generate opportunity through good jobs with competitive pay, events that support local businesses, and substantial tax payments to all levels of government,” said Michelle Mason, FASAE, CAE, president and CEO of ASAE.

The association partnered with Oxford Economics to survey 20,000 associations for the report. In addition to its wider findings—for instance, national and state associations directly support 1.1 million jobs—the research underscores the impact that association events have on the U.S. economy.

To wit: More than 272,000 association events each year attract nearly 52 million participants and generate about $43 billion in spending—a significant portion of the roughly $110 billion spent overall on meetings, conventions, and exhibitions in the U.S., according to the Meetings Mean Business coalition.

ASAE’s full research report can be found here.

Tax Changes Coming?

Mary Kate Cunningham, CAE, senior vice president of public policy for ASAE, noted during the press conference that “some tax cuts that are due to expire at the end of 2025 could have a big effect on the way nonprofits are treated” if Congress does not vote to keep them intact for 2026 and beyond. In fact, “this is the most serious threat we have seen in the last 50 years.”

As a result, “ASAE seeks to build a large coalition of associations around the country to bring the message to legislators in Washington, D.C., about how much impact associations have on the American workforce.”

Cunningham added that more details on that initiative will be released in the coming weeks.