From the wide view, the hotel industry should expect to see only a modest rise in demand (1.8 percent) and guest-room rate (3.0 percent) in 2024, compared to a strong 2023 that saw pent-up demand unleashed after the Covid pandemic. But from a narrower perspective—namely, looking at the hotels that accommodate the most business events—both demand growth and room-rate growth might well surpass those estimates.

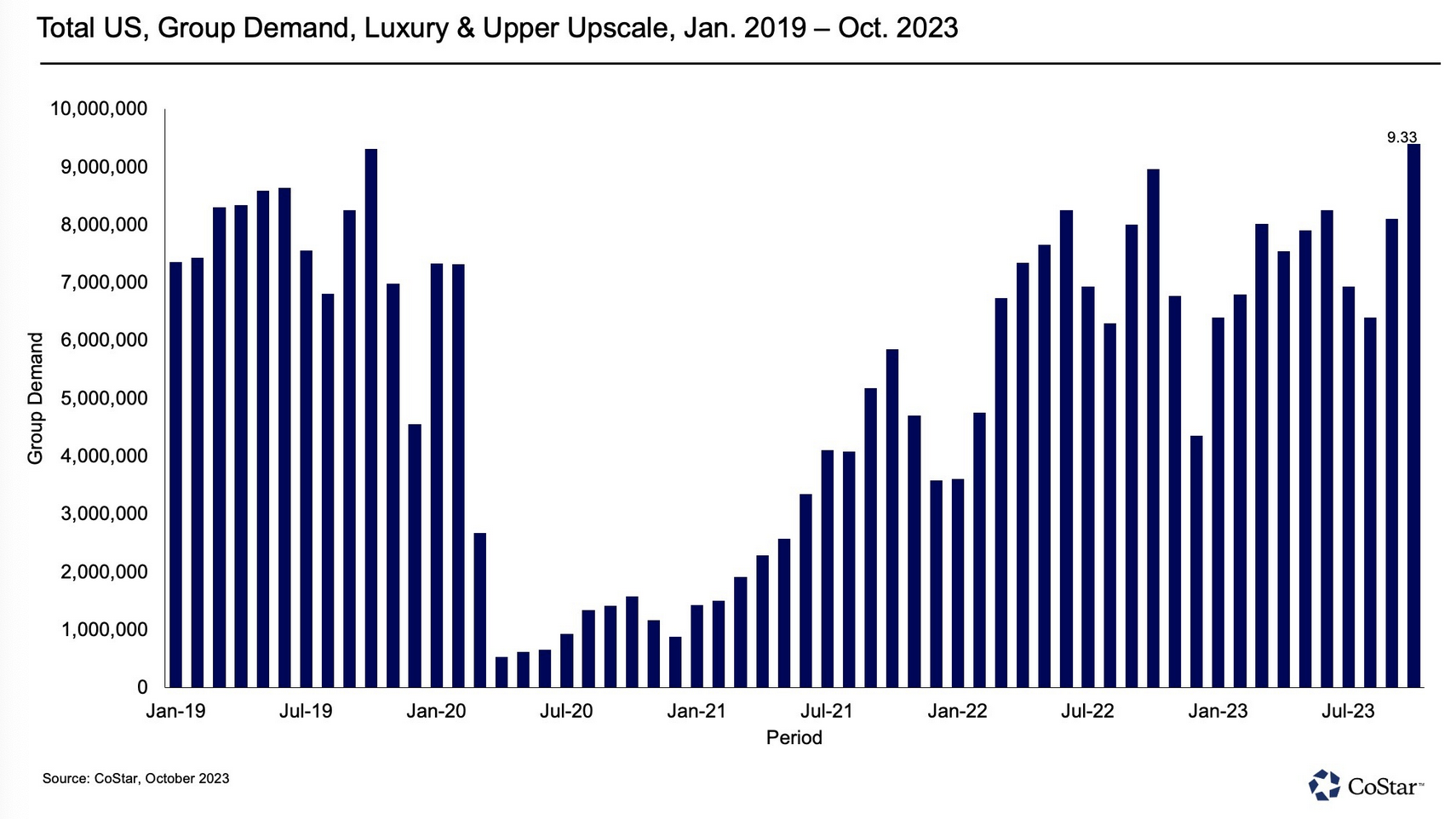

Research conducted in Q4 2023 by hotel-industry analyst firm CoStar finds that the upper-upscale segment, which contains the bulk of meetings-focused properties, has done better recently than other segments. In fact, group business (see chart) has recovered to the point that more group rooms were sold in October 2023 than in October 2019. CoStar also expects acceleration of the group market in spring 2024 as well as in September through early November 2024.

Research conducted in Q4 2023 by hotel-industry analyst firm CoStar finds that the upper-upscale segment, which contains the bulk of meetings-focused properties, has done better recently than other segments. In fact, group business (see chart) has recovered to the point that more group rooms were sold in October 2023 than in October 2019. CoStar also expects acceleration of the group market in spring 2024 as well as in September through early November 2024.

However, it’s not just competition from other meeting groups that has planners in a tough spot as they choose sites and negotiate contract terms for their 2024 events. Leisure travelers who tend to stay at luxury hotels are shifting from using suburban resorts to somewhat less-expensive downtown properties, according to Jan Freitag, national director of hospitality market analytics for CoStar. This could squeeze groups who seek urban properties for management meetings, customer events, and other small to mid-sized business gatherings.

As for corporate transient business being a competitor to meetings for upper-upscale guest rooms, only about half of the top 25 urban markets in America are near their 2019 levels of transient demand. However, CoStar notes that the hybrid-work model, where employees are expected to be in office only part of the week, might cause a boost in midweek travel demand over the next year because the time frame for most employee travel could be more narrow. For the major urban markets, that could mean more hotel-demand compression on Tuesdays, Wednesdays, and Thursdays than ever before, leading to less negotiability for planners.

Lastly, the rate of inflation has not been fully accounted for in hotel’s guest-room rates, notes Freitag. As a result, other in-house meeting elements, from space rental to event production to food and beverage and others, are likely to be areas where hotels remain firm on pricing to offset the rise in labor and other costs.