A lot has been said and written about the trials meeting and event planners have faced over the past few years. While nobody needs convincing that it’s been a tough road, we have some new comparative data that illuminates the pandemic-related challenges for third-party planning companies, and the recovery they’re now seeing.

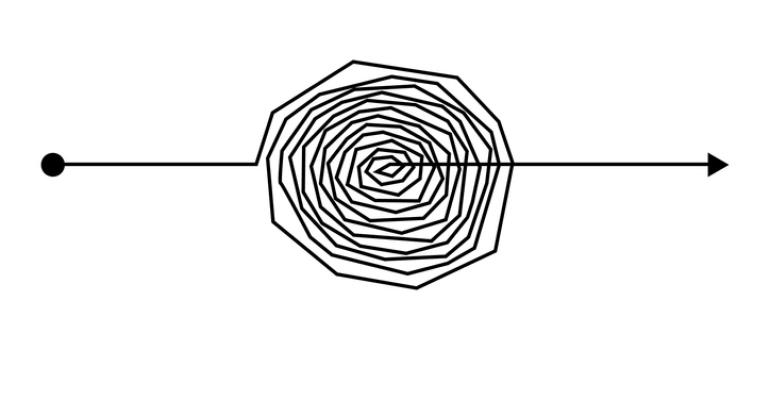

Consider this remarkable statistic: The median number of room-nights booked for meetings and incentive travel by CMI 25 companies was five times larger in 2022 than in 2021: In just 12 months, the median went from 26,761 room nights booked for meetings and incentives to 138,894.

The CMI 25 is MeetingsNet’s long-running list of the 25 top independent planning companies, focused on corporate meetings and incentive travel booked out of North America. For our 2023 report in the September/October digitial magazine, we gathered data on business volume in 2022; last year we collected information on 2021 (and have been doing so for well over a decade).

Compare the two years and you get a strong sense of the earthquake that hit

our industry and how it’s putting itself

back together. Here are some more stats

to think about:

Staff size: The median staff size for CMI 25 companies went from 95 in 2021 to 134 in 2022. That represents an enormous investment in recruitment, onboarding, and training at a time when the job market has been tight.

In-person corporate meetings: The median number of corporate meetings that CMI 25 companies planned went from 120 in 2021 to 413 in 2022. That’s not quite up to the median number we reported in 2019 (575), but it’s a dramatic return of business over the same period when companies were working to staff up.

Virtual meetings: At the same time in-person meetings have seen a major rebound, stand-alone virtual events planned by the CMI companies have fallen off a cliff. The median number was 92 in 2021 and dropped to 21 in 2022. While it can’t be compared to the stress of converting to virtual meetings on the fly in 2020, third parties are now faced with recalibrating their staffing and technology to meet the needs of yet another new environment.

You can find more aggregate comparisons in our 2023 CMI 25 report, and then check out the individual company stats as well as news, images, and executive commentary about this fast-changing industry segment.